Guide to Completing Your Micro-Entity Income Statement

Print

Modified on: Wed, 11 Jan, 2023 at 9:01 AM

This guide will help you to correctly input the company’s income statement details. Using these details Inform Direct will automatically compile a compliant micro-entity income statement page. The income statement summarises the company’s trading over the accounting period. It shows the company’s income from sales plus any other income and how this compares to the expenses incurred to reach the company’s profit/surplus or loss/deficit over that accounting period.

1. Check the currency

Inform Direct will automatically select the currency to apply to the accounts based on the currency that the company’s share capital is denominated in. However, if you notice that the currency denomination is incorrect you should navigate back to the ‘Balance sheet’ step where you can change it using the drop-down currency list provided.

Note: Use the left hand side navigation menu to travel back to the Balance sheet step to change the currency if required.

2. Don't forget to enter comparative values

Unless the company was incorporated within the last 18 months and this is the company’s first set of financial statements, you should be entering values for both the current period and the previous financial period. However, if you used Inform Direct to submit your micro-entity accounts last year you will find that Inform Direct has retrieved the prior period values for you and there is no need for you to manually enter them.

3. Enter the income that the company has earned over the accounting period

The company’s income will fall into one of the two following categories:

Turnover: otherwise referred to as the company’s ‘Sales’. You should enter the income earned by the company during the financial period from providing goods and services that fall within the company’s ordinary trading activities. The total value of turnover recorded in the accounts should be after the deduction of any discounts offered and if the business is registered for VAT it should not include the VAT element of any sales price. For some companies, such as some limited by guarantee companies, ‘Turnover’ may also include items such as membership fees, grants and donations.

Other income: the total value of any other income not already included in ‘Turnover’. This will usually consist of interest earned on investments and bank accounts, but could also include income from the sale of capital assets, insurance recoveries, etc.

When you are entering the company’s income into Inform Direct you should enter them as positive values. The screenshot below shows the two categories of income that you should enter amounts for (where applicable):

4. Enter the expenses that the company has incurred over the accounting period

The expenses incurred by a business can be those directly linked to trading or they could relate to more general administrative expenses. For micro-entities expenses must be allocated to one of the five following categories:

Cost of raw materials and consumables: the costs incurred over the period of buying or producing the goods or services sold by the company. For some companies, such as some limited by guarantee companies, this may also include administrative expenses, such as stationery, audit fees, advertising, insurance and legal fees.”

Staff costs: the total amount paid by the company for work performed by employees during the financial period. This includes salaries and wages, pension costs, employer National Insurance contributions, the costs of using a payroll service and any other costs directly related to the employment of staff during the financial period.

Depreciation and other amounts written off assets: When a business purchases a fixed asset, that is an asset that will be used by the business for more than one year, although the cost of the asset may be paid for upfront it is only reflected in the accounts by gradually spreading the cost over the whole useful life of the asset. A portion of the purchase price of the asset is charged to the income statement each financial period. This is known as depreciation. For example, a company purchases a computer for £3,000 and determines that the computer has a useful life of 3 years. In the year of acquisition, although £3,000 has been paid for the asset, this full amount is not shown as an expense in the profit/surplus and loss/deficit. Instead, £1,000 is shown as the expense of depreciation in the profit/surplus and loss/deficit. In each of years two and three another £1,000 will be charged to the income statement as the expense item ‘Depreciation’. In this way the actual purchase cost of the asset is spread over three years in the accounts.

Other charges: The total value of any other expenses for the accounting period, not already included in another income statement expense category.

Tax: Enter the estimated charge (or refund) of corporation tax based on the company’s profits (or losses) for the accounting period. Company profits can be estimated as total income less all costs/expenses, although when HMRC calculate the actual tax charge for the period a difference may arise as not all expenses are deductible for tax calculation purposes.

When you are entering the company’s expenses into Inform Direct you should enter them as positive values. They will be automatically deducted from the company’s total income to reach the profit/surplus (or loss/deficit) earned over the accounting period. If the company is expecting a tax refund for the period then enter this as a negative amount.

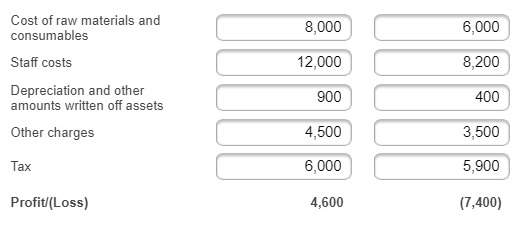

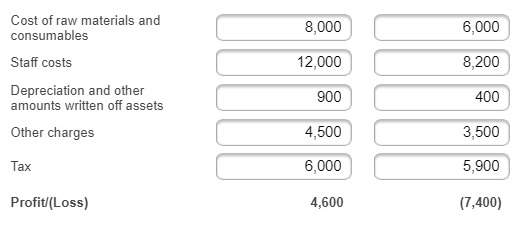

The screenshot below shows the different expense categories that you should enter amounts for (where applicable):

5. Check the profit/surplus (or loss/deficit) shown for the period

Inform Direct automatically calculates the profit/surplus or loss/deficit for the accounting period, based on the amounts you have entered for income earned and costs/expenses incurred. Please check this calculated value to ensure it is correct.

Did you find it helpful?

Yes

No

Send feedback Sorry we couldn't be helpful. Help us improve this article with your feedback.